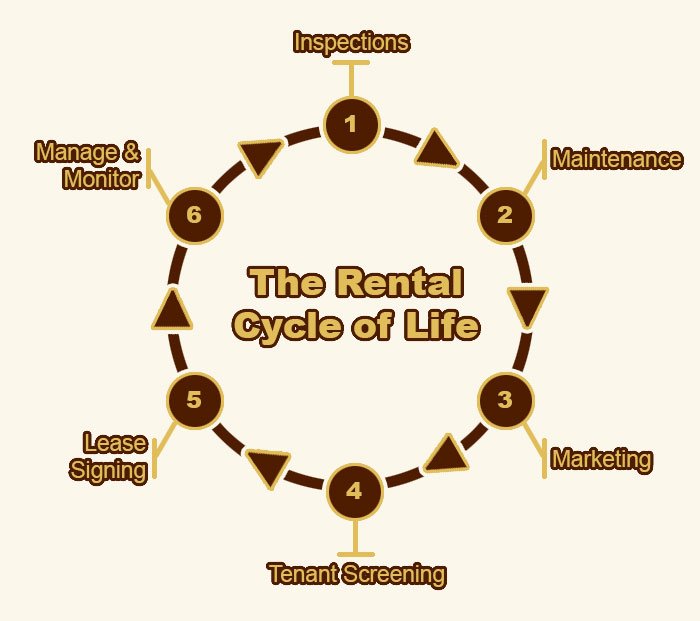

Item 2 on Far West Property Management’s Rental Cycle of Life, is Maintenance. I know that real estate investors are ultimately concerned about one thing with regard to their rental properties: ROI (Return on Investment). They work hard, and often long, to get to the point where they can buy a rental income property in Prescott and when they find it, they make every effort to buy it right – right property, right location, right terms, right price.

Item 2 on Far West Property Management’s Rental Cycle of Life, is Maintenance. I know that real estate investors are ultimately concerned about one thing with regard to their rental properties: ROI (Return on Investment). They work hard, and often long, to get to the point where they can buy a rental income property in Prescott and when they find it, they make every effort to buy it right – right property, right location, right terms, right price.

Most investors will have done the numbers before making the offer, and will have made allowances in calculating a projected ROI, for expenses that will be necessary in operating the property. Often, though, we see less-experienced rental investors who don’t allow enough budget for keeping their investment in good condition. Most understand the idea of having a margin of profit between their incoming money and their outgoing money. Not as many have a good feel for what that margin should be.

It is not uncommon for me to be approached by prospective clients who want me to manage a rental for them that has a projected rent rate of say, $1000 per month. Then they tell me that they are servicing a mortgage of around $850 per month, including taxes and insurance. After a few more questions I learn that the unit is 40 years old and hasn’t had a new roof at all, or a new heating and air system, water heater or exterior paint job within the last 25 years.

It is not uncommon for me to be approached by prospective clients who want me to manage a rental for them that has a projected rent rate of say, $1000 per month. Then they tell me that they are servicing a mortgage of around $850 per month, including taxes and insurance. After a few more questions I learn that the unit is 40 years old and hasn’t had a new roof at all, or a new heating and air system, water heater or exterior paint job within the last 25 years.

Then it is necessary for me to help them understand that because of maintenance and upgrade it will almost certainly require, as well as other expenses, including my fees, they won’t be able to break even on this investment, let alone realize positive cash flow or any ROI. Often such prospective clients may have inherited such a property, or perhaps it has been their primary residence, which they now have to vacate due to a job change or other such unexpected event. They often want to rent it out to avoid selling at less than they want, or think it’s worth. In any case they often have little or no experience in real estate investing.

A few general “rules of thumb” can be helpful in such situations:

Typically, the newer the property, the less immediate maintenance or upgrade it will need.

The more continuously and regularly it has received preventive maintenance, the less likely it is that major expenditures will be needed in the short term.

Based on the above two items, I recommend somewhere between 30% and 50% more than the fixed monthly expenses should be a minimum monthly rental rate on a well-maintained and/or newer property. And, of course, the property would need to be worth that on the current rental market.

So, you might think that for an article on item two of Far West’s Rental Cycle of Life, i.e., Maintenance, we’ve spent a lot of time talking about Return on Investment. Well, you’re right, and there’s a good reason for it. Basically, it’s this: Sooner or later, in one way or another, the amount of return on your investment is going to be impacted, for better or worse, on the care your investment has received over time. It’s just like when your mechanic tells you that the more regularly and reliably you change the oil and filters on your vehicle, and provide it the recommended maintenance at the appropriate times, the longer its life will be. It’s true of the car or truck, and it’s true of your rental investment property.

A lot of folks flinch at spending the money necessary to keep up with the needed maintenance on a property, thinking that it is cutting into the money they receive for the month. And, it’s true it does diminish the net income for that month. But, the truth is, it is most likely saving them a lot more in future costs and preserving, if not increasing the value of their investment. The bottom line is, a wise investor must factor maintenance costs, especially preventive maintenance costs, into the formula for ROI on a rental property. Failure to do so can make it a recipe for disaster instead of a formula for success. For more information about what Far West Property Management can do to help you with your rental investments, call Dave Hamill at 928-772-9400.

For more on how we can help you manage your rental properties, contact us today!